The benefits of company registration

MIIC Author

Thinking that it would be a good thing to avoid taxes and other obligations, some Jamaicans run their businesses under the radar in the hope of more cash taken home at the end of the day.

However, they are missing out on many opportunities, one of which is growth funding. Investors and bankers alike are much less likely to lend or invest for expansion to informal operations.

By registering a company, entrepreneurs allow their businesses to become a legal entity which will attract funding and other forms of support.

Officials at the Companies Office of Jamaica (COJ) told the Jamaica Observer, “When a company is incorporated, it becomes a legal entity. Among the benefits enjoyed are that of limited liability, which means the liability of a member is normally limited to the extent of the unpaid amount on his shares in the company.”

The limited arrangement allows a separation of company and individual assets, so if a company is sued, one’s personal assets are protected, unless they are assets which were bought through and for the company.

Registered companies can sue and be sued in their own name. It is advisable to separate personal and business assets.

A registered company also enjoys perpetual succession, which means that even though shareholders might be added or subtracted, the change in membership does not affect the existence of a company.

An informal operator’s business is likely to die when he dies but the registered company continues to exist and can be run by others or sold for the benefit of relatives.

Financial lenders and investors are more likely to consider your business plan and lend you money for expansion if your company is formally registered.

Steps involved in

So, considering the benefits of formalisation, what is required for registering a company? There are two structures to choose from in Jamaica. The first is a company which is a commercial enterprise registered or incorporated under the Companies Act. A company can either be non-profit (charity, club, NGO, etc) or profit generating.

The other structure which can be registered is a business name which is a sole trader, partnership or trade name registered under the Registration of Business Names Act.

Registration is done at the COJ either in person or online. You will need properly completed Articles of Incorporation comprising Form 1A, which is the Article of Incorporation for companies limited by shares (profit making).

For a not-for-profit entity, you will need Form 1B comprising Articles of Incorporation limited by guarantee without a share capital. These articles set out the rules for running the internal affairs of the company and are the two most common forms of company incorporation.

You will also need a properly completed business registration form (BRF 1) otherwise known as the “super form” which allows for “one-stop registration” at one government agency instead of registration being done at multiple government offices.

The aim of this form is to collect all information required to be given by the business owner to various offices at one focal point which is the COJ.

The business owner will also need to provide an original and valid government-issued identification of the owner or principal director and the person declaring the accuracy of the form.

Companies are able to obtain a Tax Compliance Certificate (TCC) at the COJ upon the registration of a name.

The TCC, which is processed by Tax Administration Jamaica (TAJ), is a document issued to an individual or company as proof that they are tax compliant and their payments of tax liabilities and wage-related statutory deductions are up-to-date.

Business owners will also need to provide a tax registration number (TRN) for at least one responsible officer ( a director or secretary). Everyone with a local address is required to produce a TRN.

Finally, for registration, you will need to pay a registration fee of $24,500 inclusive of stamp duty.

With the conjoining of all the forms involved in the company incorporation process into one package, the fees were combined to reflect this.

A company which offers limited liability but will have to file an annual return with the COJ each year.

For a business with no limited liability, however, there is no annual return filing with the COJ and it will just renew the business certificate every three years and notify the registrar of any changes in the particulars originally registered in order to be in compliance with the agency.

With reference to a company structure, a company must start with a company secretary and at least one company director. For a business, the entrepreneur may start as a sole trader or a partnership.

Each entrepreneur or investor is encouraged to research the business activities they will engage in, and then make an informed decision as to whether it is beneficial to register as a company or a business. Both these entities have varying benefits and obligations.

General issues for consideration include level of risk, size of business, need for financing, capital availability, area of trading, level of regulation and cost of compliance.

Source: Jamaica Observer

Recent News

See all news

Posted on 11/12/2025

Sygnus Real Estate Finance breaks ground for Lakespen Industrial Park

Sygnus Real Estate Finance Limited (SRF) officially broke ground on its transformative 55-acre logistics and industrial development, Lakespen Industrial Park, on Tuesday, December 9. The ground-breaking ceremony follows SRF receiving regulatory su...

Posted on 11/12/2025

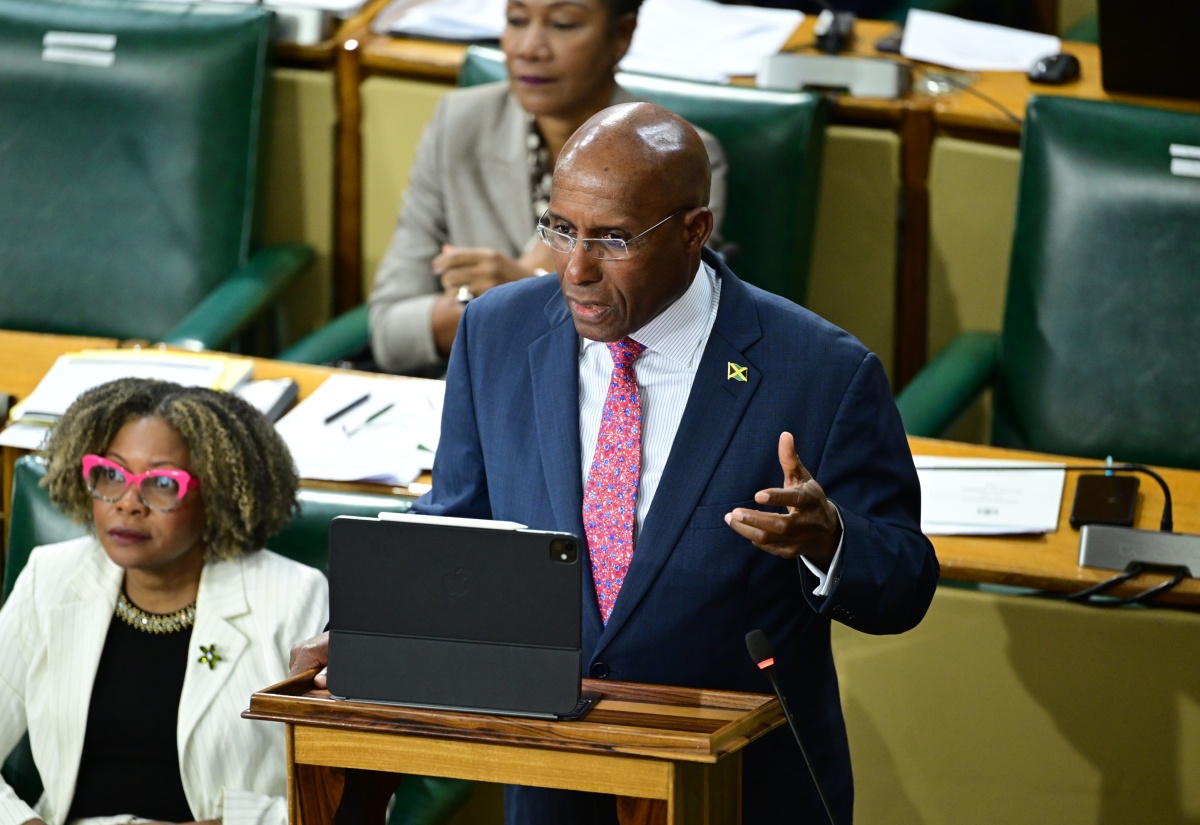

Gov’t targets craft sector as new pillar of creative economy

WESTERN BUREAU: State Minister in the Ministry of Industry, Investment and Commerce Delano Seiveright has declared that Jamaica’s craft sector is poised for a sweeping overhaul as the Government moves to reposition craft not as an afterthought but...

Posted on 11/12/2025

COJ Reduces Fees for Businesses in Hurricane-Hit Parishes

The Companies Office of Jamaica (COJ) will be rolling out several measures to provide financial and economic relief for business entities in the parishes hardest hit by Hurricane Melissa. Minister of Industry, Investment and Commerce, Senator the ...